Google’s Attempt To Commoditize Everyone

Plus, results on my recent AI ad experiment

Maybe the most important question we have in tech right now is this: How do we kick Mark Zuckerberg’s ass? For the sake of capitalism and competition, the tech giants must die. I sincerely desire unemployment for Tim Apple. Google should be yeeted onto the surface of the sun. Jensen Huang should be forced to work at Denny’s for 6 months due to cash flow issues. Tesla clearly needs its own DOGE department. And Jeff Bezos? Well he checked out years ago via a divorce, a yacht, and a house in Miami, so we are good there.

I’m being snooty, but the feeling behind it is benign. A world where more startups succeed is a better one, and the innovation smothering effect of such large companies hoovering up all of Silicon Valley’s talent is a net negative for all of us.

The reason these companies are so dominant is they got hella cash and they spend it good.

A more sophisticated way to say that is there are three underlying reasons to why these companies are so strong:

Tech companies today are run by founders with voting privileges. Larry Page and Sergey Brin control 51.3% of Alphabet’s voting power despite minority equity ownership. Google’s 2004 founders’ letter explicitly stated this structure provides “stability over long time horizons”—corporate governance speak for “we can do weird shit without getting fired.” This allows executives to take large risks that would make normal CEOs lose their jobs (Facebook buying Instagram, Netflix pursuing originals, Google spending heavily on Android and Chrome).

Software defined businesses are structurally more profitable than the hardware heavy businesses of yesteryear. Mostly because their only real fixed costs are servers and office buildings, they have more cash to spend.

They have mostly spent this money on commoditizing their complements, thus extending their network effects and attention aggregation.

Now, I know that last sentence was boring and sounded like the dirty talk of a Harvard Business School professor, but it is the most important one I’ve said so far, so pay attention. To “commoditize their complements,” founders will intentionally wreck the profits for the firms above and below them in the tech stack (complements). The goal is to crank up the competition so hard that prices plummet to basically zero, making sure no rival can emerge elsewhere in the tech stack (commoditize). This drives overall demand through the roof, and all that sweet, sweet consumer surplus gets funneled right back to your quasi-monopoly. Potential competitors either have to attack your strongest market or have too low of margins or too much competition in complements to your profit center.

This playbook has worked well for the last 25 years of the internet, and, fairly, tech giants are attempting to apply it to the new tech paradigm of AI. Existing legacy companies are now attempting to commoditize AI models by making them interchangeable within their workflow software (as I discussed on Sunday in an exclusive interview with Adobe). Simultaneously, these model companies are attempting to commoditize applications by making it dead simple to create workflow software (such as the case with Claude Code which I wrote a research report on here).

Now, Google is doing something far more ambitious, they are attempting to commoditize the internet with their newest announcement on Sunday.

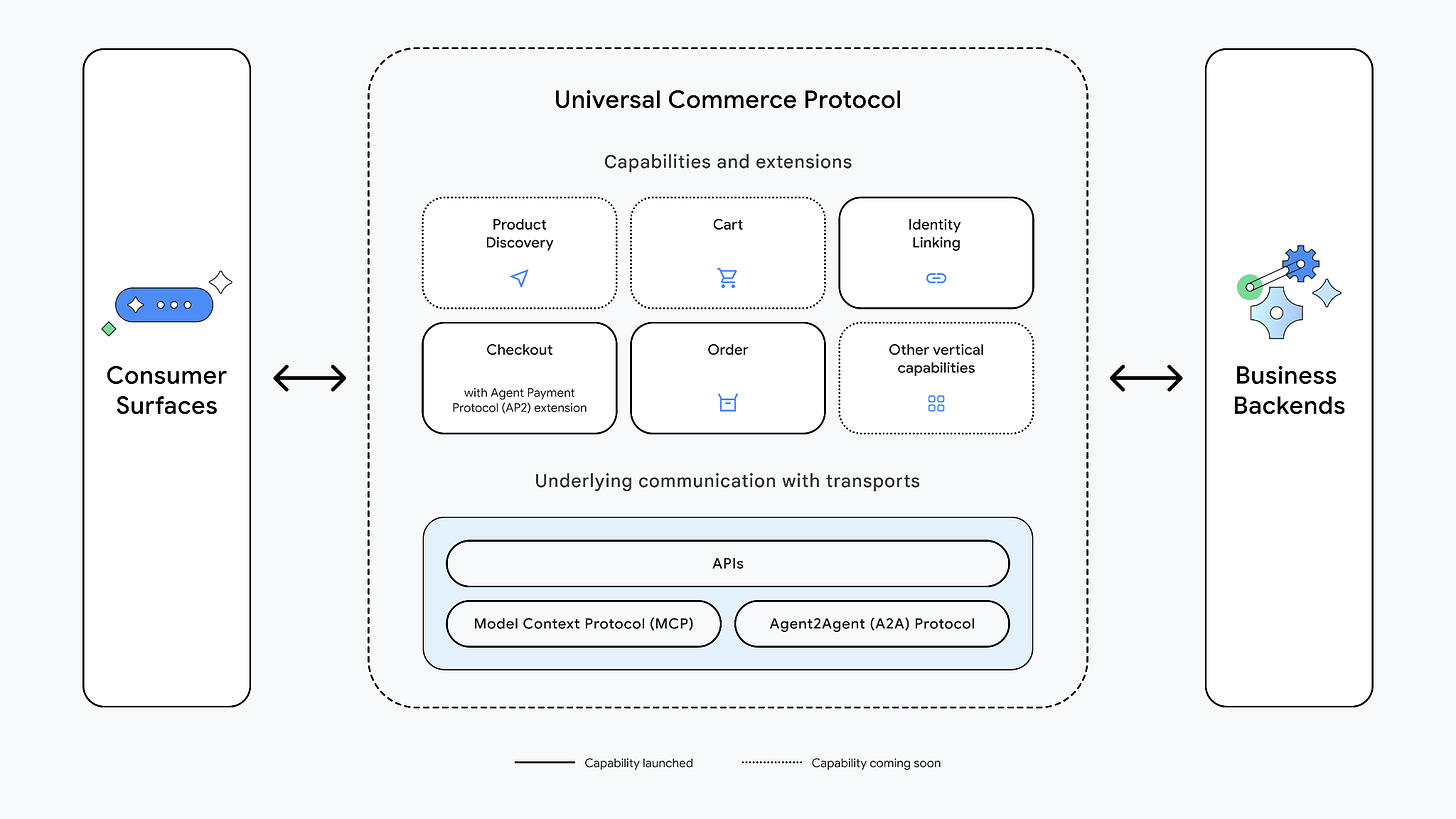

What UCP actually is

The Universal Commerce Protocol (UCP) is an attempt to standardize how commerce works for AI on the internet. We made shopping on the internet much like going to the mall, where you browse individual e-commerce websites. Each store is designed with the human eyeball and psychology in mind.

UCP transforms a website from that store into a set of standardized capabilities. An AI agent doesn’t need to understand your branding, layout, or UX—it just needs to know, deterministically, how to buy something from you, so UCP makes it easy to go through things like product discovery and carts.

Importantly, the business still remains the merchant of record; UCP doesn’t turn Google or anyone else into the seller. The point is not to own commerce, but to make commerce interchangeable.

The strategic implications (and why this is classic Big Tech behavior)

Once you see UCP clearly, it snaps into a very familiar pattern.

This is “commoditize your complement”, almost embarrassingly identical to previous eras.

Historically, Google’s profit center is intent and attention. Everything downstream of that—websites, publishers, ecommerce flows, checkout UX—are complements. They don’t need to be profitable. In fact, it’s better if they are generating just enough cash flow to buy more Google ads.

UCP attacks the most expensive and differentiated part of ecommerce: custom execution. By standardizing buying itself, Google is pushing the margins of commerce down the stack. Checkout becomes a commodity. Storefronts become interchangeable. “How you buy” stops being a source of differentiation.

When complements become cheap and interchangeable, demand flows upward. More transactions. More agent-mediated queries. More moments of intent routed through the layer that coordinates everything.

And that layer is where Google lives.

Why the hell merchants would agree to this is a fascinating question. The reality is that people are already using AI to research products, and are justttt starting to use AI agents to make purchasing decisions for them. If merchants don’t find a standardized way to make their websites AI friendly, they’ll lose out on potential sales to competitors who will. UCP also allows businesses to still control their backends and remain the merchant of record.

There are a few second-order effects worth calling out explicitly:

Execution stops being the moat

If everyone can be bought from equally easily, the only durable advantages left are price, fulfillment, policy, and brand. Anything else gets flattened.Power concentrates at the decision layer

When execution is cheap, the scarce resource becomes deciding what gets chosen. Defaults, rankings, and recommendations become the choke point.Advertising pressure moves upstream

Once checkout is commoditized, the only place left to extract rent is before the transaction—inside the decision itself. This is why UCP is inseparable from the advertising question.This looks “open” while being strategically centralizing

UCP feels merchant-friendly because it preserves merchant-of-record status. But strategically, it does what Google has always done: lower profits everywhere except the layer it controls.

Seen this way, UCP is a move to turn the internet’s messy, human-shaped commerce layer into a clean, machine-shaped complement—so that advertising become even more central.

And that’s the setup for why ads inside chatbots are suddenly on the table. And why, in my view, they’re wildly misunderstood. For paying subscribers, I’ll describe what everyone is misunderstanding about ads in chatbots, how my experiments over the two last weeks changed my view, and how the strategic landscape will shape out.