2025 is Winding Down, Nuclear is Blowing Up

The Weekend Leverage, December 21st

9 months ago, I bet my family’s financial future on The Leverage. It was probably unwise. It was certainly risky. Still, I could feel in my bones that the world needed what I thought this publication could be. I wanted this place to be a tasteful yet analytical, rigorous yet playful look at technology markets.

I am pleased to tell you that it is working.

Next year you are going to see a dramatic expansion in the ambition of this publication. Our first large-scale event in San Francisco. Guest writers. Video essays on my research. Conference appearances. A mini-book publishing in Q1. And as always, spooky-accurate analysis hitting your inbox multiple times a week. Doing all this while still being the sole full-time employee here is scary, but all of your subscriptions are what gives me the confidence to try. Thank you.

I am taking this big of a swing because of the state of technology. There are, of course, exciting things happening in large language models. However, AI has acted as a catalyst. Founders are so much more ambitious now versus a decade ago, and are aggressively trying to make a better world. How could I not help but try and keep up? If you have any feedback, please reach out to me. I want to hear from you.

Anywho, enough of that feely stuff! This was an exciting week for tech news that I want to quickly cover before taking off for the holidays.

But first, I am excited to welcome a new sponsor to The Leverage, Box.

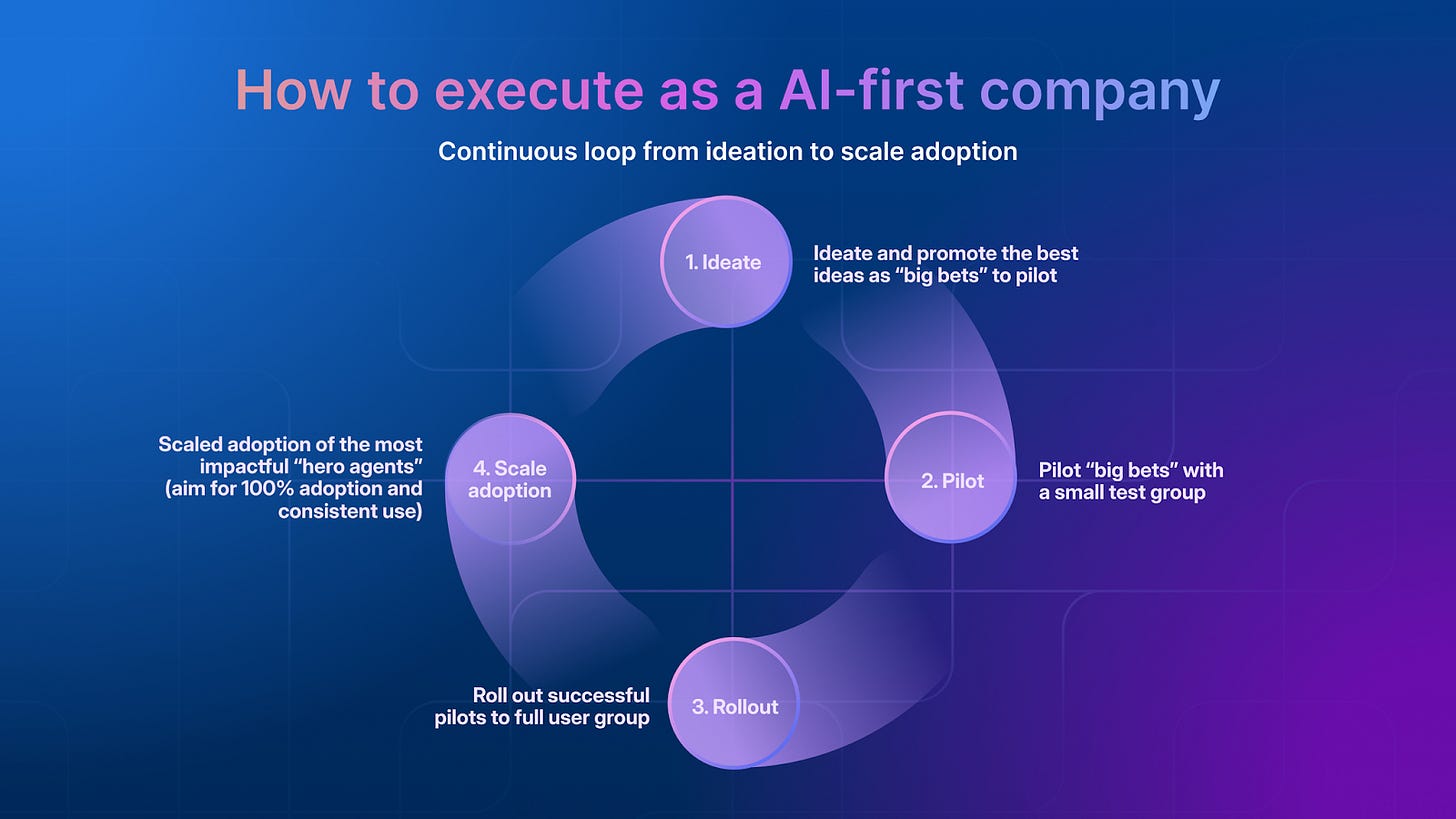

60% of enterprises expect AI transformation within 2 years, and Box’s Executing AI-First Series is the step-by-step playbook for empowering teams to thrive in the era of AI.

In this series, you’ll learn:

How Box approached becoming AI-first through its value realization strategy

How to Deploy agents with an ideate>pilot>rollout>scale plan

How to be an AI manager

How to measure what matters by tracking AI agent impact

Read the first article in Box’s series and follow along for actionable insights and downloadable templates.

MY RESEARCH

How to make $100 billion on taste. There is something in our current media environment that is just…off. Short-form videos, ragebait, binging and forgetting a new show a week, we are meant for more than this. What took us to this point wasn’t malicious founders, but cold economic logic. Therefore, the best way to fight against this phenomena is to build a new breed of company that can have just as large of financial outcomes as Netflix while immunizing its customers against the slop being force fed to them by the current internet giants. Frankly, I didn’t think this one would resonate, but MAN, people have really loved this piece. From paid subscriber Leann, “Wow. Wow. Wow. I think this is the most important article for business leaders who actually *care* to read. I upgraded to read the playbook and am not disappointed.” Read it here.

WHAT MATTERED THIS WEEK?

AI LABS

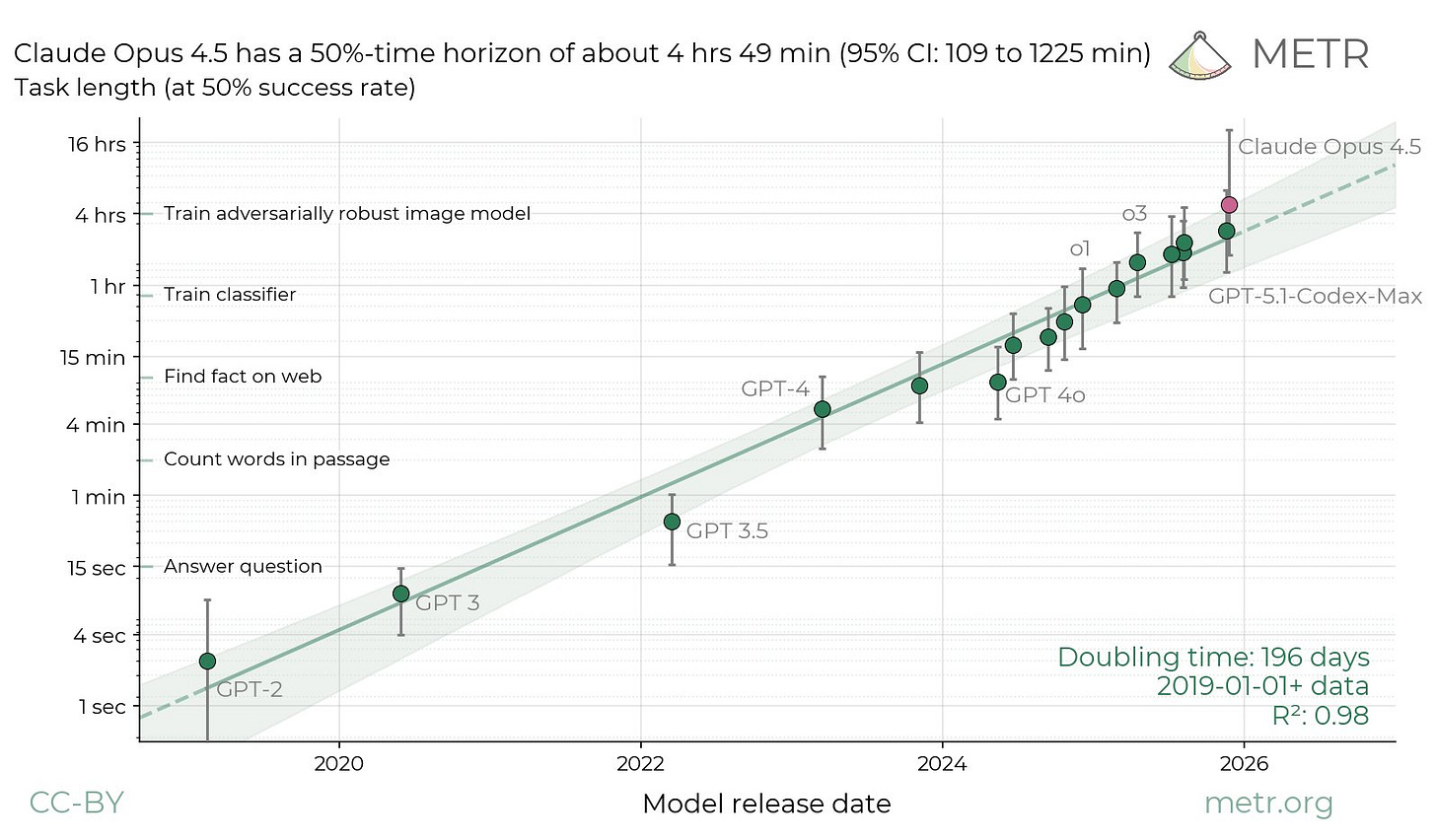

Models are getting better, predictably. METR, an AI research non-profit, just published the following chart. It made me go, “eeee.”

There is a lot happening here, so allow me to explain. The “time horizon metric” mentioned in the title measures something intuitive: if a human software engineer takes X hours to complete a task, and an AI agent succeeds at that task 50% of the time, then X is the model’s 50%-time horizon. It’s basically asking “how long of a task can this thing reliably handle?” Claude 3.7 Sonnet hit 59 minutes back in February. Claude Opus 4.5 just registered at 4 hours 49 minutes—nearly a 5x jump. METR’s broader analysis shows this metric has been doubling roughly every 7 months since GPT-2 in 2019. It is close to becoming a “Moore’s Law for AI agents”, and if you take the exponential seriously, the math gets spicy fast. We’d hit week-long autonomous task completion within 2-3 years, month-long projects by decade’s end.

The question is whether you believe in the exponential. On one hand, the trend has held remarkably consistently across six years and multiple architectural generations—that’s not nothing. On the other hand, there are good reasons to expect the curve to bend. Human software engineering isn’t just “longer versions of the same task”—as duration increases, you encounter coordination problems, changing requirements, and compounding errors that scale nonlinearly. The difference between a 5-hour task and a 5-day task isn’t 24x more of the same work; it’s a qualitatively different problem involving memory, planning, and course-correction that current architectures may not address. If AI progress has mostly been raising baseline capability rather than improving the slope of how models degrade over task length, that exponential extrapolation breaks down before you reach truly long horizons. Still, even if the curve flattens, we’re entering territory where day-long autonomous coding sessions become plausible within the next year or two—and that alone reshapes how software gets built. Eeee. For more on why Anthropic is becoming so dominant in tasks like this, you can read my research report here.

THE SLOPPENING

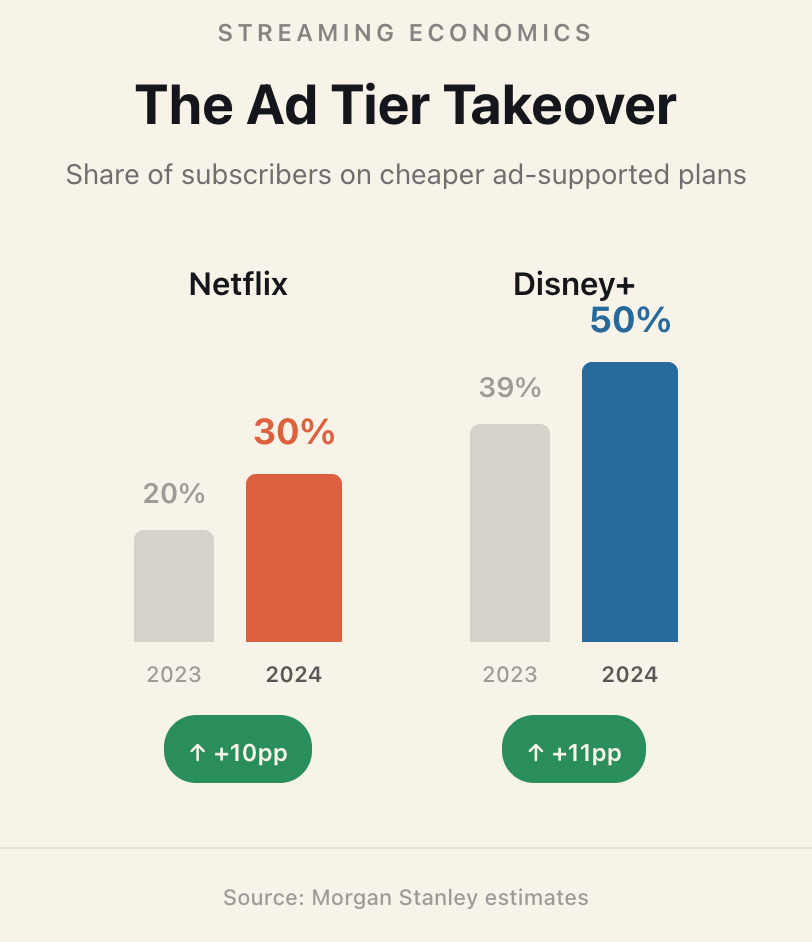

Streamers are losing commercial-free subscribers. I remember when the primary selling point of streaming was the lack of ads. Now, the streaming industry’s pivot to advertising is accelerating faster than anyone predicted. Morgan Stanley’s latest entertainment outlook found that ad-supported tiers now account for 30% of Netflix subscribers and a full 50% of Disney+ subscribers—up from 20% and 39% respectively just a year ago. More striking is that the firm estimates that all net subscriber growth in 2025 for both platforms came from ad-supported plans, while the number of users paying for ad-free viewing actually shrank.

This means that the sloppening is now being actively subsidized by consumer choice. When over 100% of net subscriber growth comes from ad-supported tiers what you’re seeing is a mass voluntary surrender of attention sovereignty. These users aren’t just watching slop; they’re paying for the privilege of being interrupted, trading cognitive real estate for a few dollars a month. The economics are self-reinforcing: ad-supported viewers are most valuable when they watch the most, which means streamers are now doubly incentivized to produce the kind of frictionless, background-noise content that keeps eyeballs glazed and engaged.

Pair this news with Meta just launching Instagram for TV, bringing Reels to the living room for the first time. The explicit pitch, per TechCrunch, “You could be watching something on Netflix and decide you don’t have the attention span for a movie or episode, and decide to watch Reels instead.” The app automatically plays the next Reel the algorithm suggests. Every incentive here is for slacked-jaw consumption.

DEAL VIBES

We can use AI to design molecules. Chai Discovery announced a $130 million Series B that values the company at $1.3 billion. Other startups pursuing a similar “AI-first molecular design” approach include Isomorphic Labs (DeepMind spin-out), which raised $600 million in 2025, and Xaira Therapeutics, which launched with $1 billion in committed funding, while PitchBook estimates generative-protein company Generate:Biomedicines is worth about $2 billion.

The basic science idea is simple: your body runs on tiny biological machines called proteins, and many medicines work by sticking to a specific protein to change what it does. Chai’s product is software that uses large AI models to (1) predict the 3D shapes of these molecules and how they fit together and (2) design new antibodies (a kind of protein “guided missile” drug) intended to latch onto a chosen spot on a target, so labs can test a small shortlist of candidates instead of experimentally searching through enormous numbers by trial and error.

This fundraising suggests investors believe “computer-aided design for drugs” is becoming a real platform category—an arc that accelerated after AlphaFold2’s 2021 breakthrough in protein-structure prediction helped convince the market that core parts of biology can be modeled much more accurately. At the same time, it underscores that the field is still in its proof-building phase. AI-generated drugs have not yet translated into a clear set of regulatory approvals, even though AI-assisted candidates are advancing through trials. The near-term landscape is likely to feature more large rounds and pharma partnerships (and a lot of attrition), with occasional high-profile clinical wins before we see whether AlphaFold-era biology actually converts into medicines at scale. Still though, very cool! More startups like this please!

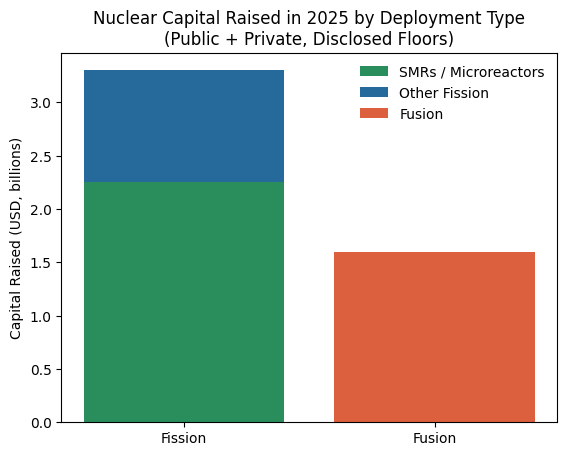

AI is bringing back nuclear power. This week nuclear energy startup Last Energy announced an oversubscribed $100 million Series C. It is the cleanest signal yet that nuclear has re-entered the serious capital cycle—moving from science project to infrastructure product. In 2025, I count 14 private nuclear startup financings totaling at least $2.9B with SMR and microreactor companies accounting for nearly half of them, including very large checks like X-energy’s $700M Series D.

The demand-side catalyst is AI, and more precisely, the rediscovery that electricity is a binding constraint. The nuance—and this is important for not overhyping the story—is that most nuclear won’t solve this cycle’s power crunch. Gas, grid upgrades, and faster-to-build resources will carry the next few years. Nuclear is about the next tranche of demand, when hyperscalers and utilities realize they can’t keep duct-taping the grid forever. The capital flowing now is essentially buying options on future scarcity rents. Most investors in these deals I’ve talked to aren’t expecting serious nuclear capacity to go online until 2030.

If you’re a reader deciding whether to care or invest in this trend, the key insight is that this is not primarily a bet on science. It’s a bet on execution in a brutally constrained market: permitting, siting, manufacturing, fuel, and financing are what determines winners. That’s why companies pitching “productized nuclear” are getting funded, and why public markets reopening to names like Oklo matter even if first deployments are years out. AI didn’t magically make nuclear easy, but it made reliable power valuable again. And when a commodity flips from abundant to scarce, entire categories that were written off suddenly become investable.

Have a great week! The Leverage will be off this week to spend time with family and to work on some longer-term project. See you soon,

Evan

Sponsorships

We are now accepting sponsors for the Q1 ‘26. If you are interested in reaching my audience of 34K+ founders, investors, and senior tech executives, send me an email at team@gettheleverage.com.

Brilliant breakdown of the nuclear renaissance! The observation that AI didn't make nuclear easy but made reliable power valuable again is such a clean way to frame it. What I find most intresting is how this mirrors other infrastructure cycles - when a commodity flips from abundant to scarce, dead categories suddenly become investable. I worked adjacent to data center planning in 2019 and everyone treated power as infinite and cheap, now hyperscalers are scrambling for generation capacity like it's 1950. Your point about most investors targeting 2030+ deployment is key tho, lots of people gona get burned chasing this trend too early.