This Email is Now 10x Better

The Weekend Leverage, October 12th

Last week, quite a few of you had feedback on how to improve The Weekend Leverage. Thank you! This edition has more analysis, more data, and more insights all for the low-cost of free. You are welcome! I’ve set a goal to make this a slap-yo-mama, tell-ya-coworker type email. So if you have any ideas on how I could make this better, please leave a comment or drop me a note.

We also had the first Leverage meetup on Friday at a showing of One Battle After Another. Thank you to all those who came to watch my favorite movie of the decade! I’d like to do more events and am excited to meet readers in person. Having you all trust me with your attention is a gift and a privilege I don’t take lightly.

This edition we’ll cover:

Prediction markets becoming yassified sport gambling

Whether AI companions have to be horny

YouTubers on the frontlines in Ukraine

Sam Altman and Elon Musk’s “creative” financing

MY RESEARCH

Which AI companions actually work? There are millions of people in the United States who are engaging with AI companions. Simultaneously, every major AI company is attempting to build a robotic friend for us to engage with. Which of these efforts works? What is the right combination of software, silicon, and sensors to make these AI companions useful? I’ve tested dozens over the last few years and wrote about the results here.

WHAT MATTERED THIS WEEK?

PUBLICS

Uh oh, someone told product marketers about AI agents. This week Adobe, Amazon, Google, Oracle, IBM, SAP, and multiple other companies distributed splashy press releases in which they bragged about their “AI agents” that could automate labor. However, for many, the actual product is…nothing like an AI agent? They are almost universally a chat interface that then feeds into relatively clunky workflow automation. Before large language models, if you wanted to do some form of task automation, you used Robotic Process Automation (RPA) where there were very specific inputs/outputs of tasks. To my mind, the beauty of AI agents is that they are very flexible and can handle high levels of task abstraction/planning. Almost none of these releases are this. They are all just little tricks of LLMs, spruced up with some new UI. Bad big tech! Bad! AI agents are real but the companies that are actually deploying them at scale are few and far between.

This is a Moloch trap everyone in tech has fallen for. If you slap the AI label on your product, sales interest increases, so every marketer is locally incentivized to do so. However, everyone doing so dilutes the power and specificity of what “AI” actually means, thus associating the positive aspects of one product with the negative impacts of some totally unrelated company.

AI LABS

One in five teens has had an AI romance, or knows someone who has, according to a survey of 1,000 American highschoolers. This is in line with what my own conversations with AI companion companies have revealed. (Don’t underestimate how many of these romantic relationships are ChatGPT either. Free software that isn’t specialized often beats paid, use-case specific ones.) One of the largest AI NSFW chatbot companies told me last week that they had “millions of users” in the United States. This stuff is far, far more popular than many realize.

“Creative financing” from X.AI and OpenAI. As these companies commence on their entirely rational buildout out of trillions of dollars of data centers, they need to marshal a level of resources not seen in this country since the Manhattan Project. To do so, Sam Altman has said “we can design a very interesting new kind of financial instrument for finance and compute that the world has not yet figured it out.” This week we got two glances at that.

First was OpenAI doing the rough equivalent of an equity value for chips swap with AMD. Right now, if OpenAI scrawls out an IOU in crayon to a company, the public markets reward the recipient of that kindergarten art with billions of dollars in equity value. So if you’re cash strapped, as OpenAI is surely feeling with trillions in bills coming down the line, it feels reasonable to say, “let’s use the value of the equity markets to pay for the chips instead.” This is very fuzzy and at some point, actual cash must be given to a man with a bulldozer so he’ll raze the homes of raccoons. But until that point, this is a way to get the earlier parts of that infrastructure supply-chain moving.

Second was Musk’s X.AI raising $20 billion in a special-purpose vehicle. This financing entity includes up to $2 billion from Nvidia (a smidge less than the $100 billion they just committed to OpenAI) plus a variety of other partners contributing a combination of debt and equity. What is interesting about this is that the vehicle is separate from X.AI. Instead, it will purchase Nvidia chips and then rent them back to X.AI over a five year period. The coverage on this deal is woefully inadequate on the details, so I can’t comment on whether it is a good idea or not.

But for both instances of this “creative financing” it is worth pointing out that there is nothing absolutely new about any of this. SPVs to offload CAPEX heavy projects have been around since the 80s in tech with firms like Flextronics happy to take a few points of margin for the service. And, equity warrants were incredibly common in the dot com bubble.

Sometimes these financing structures are good, sometimes they are bad. What actually matters isn’t the vehicle, it’s that the end asset generates buckets of cash. The overall size of the investment is irrelevant—it’s whether the companies can generate enough revenue and cash fast enough to pay down the debt. In that regard, OpenAI has a much more convincing argument with their 800 million users than X.AI, which is essentially staked on the idea that “our founder is Elon Musk.”

DEAL VIBES

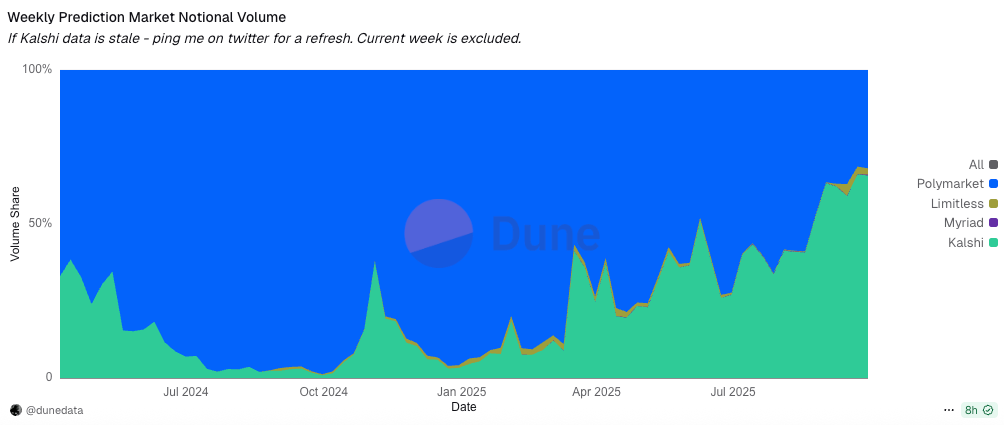

The great battle of prediction markets are on. In one corner is Kalshi, which raised over $300m in at a $5b valuation led by Sequoia and Andreessen Horowitz this week. Simultaneously, their primary competitor Polymarket, raised $2 billion from the parent company of the New York Stock exchange at a $9B valuation. There is a long history of bad blood between the companies, with both’s respective employees calling each other out over X. While Typescript fingers have turned to Twitter fingers, Kalshi has been busy grabbing market share. Polymarket pioneered the category, but Kalshi went from <5% of volume in January to over 65% as of September 30th.

Screenshot from Dune Analytics

Kalshi equity holders have used this data point as a reason to do victory laps (and as a rationalization for more than doubling the valuation of the company since June). However, it is very, very important to point out that Kalshi has essentially become a sports gambling website for Americans. Since the college football and NFL seasons started, over 90% of the volume on the platform has been sports. Meanwhile, sports is the leading category on Polymarket, but it has much more diverse market activity.

Screenshot from Dune Analytics.

The reason I’ve been so excited about these two companies is because I think having another way to incentivize truth seeking is very important in a world with infinite AI content. (For a deep dive on the category, find my research report here). As such, if either company continues down the category of just being cheaper ways for people to gamble on the New England Patriots, I’ll be incredibly disappointed.

Death to the lawyer? Outside of coding, legal workflows are ones that seem most primed for disruption by large language models. Since almost the entirety of the field is conducted via the written word, LLMS can be enormously useful in automating work. This is a generally accepted fact. However, what is deeply unclear is how startups should utilize AI capabilities to compete. What type of AI product you build and how you position/sell that is a question that is far from answered.

Replace the vertical task: LLMs have jagged edges—areas where they are exceptionally smart and others where they are exceptionally dumb. Therefore you should sell task specific, AI powered products to augment workflows. EvenUp raised $150 million in Series E funding at a valuation north of $2 billion on the basis of using AI to automate very tedious tasks specifically for personal injury lawyers in the United States.

Replace the horizontal task: In areas where LLMs are exceptional and the use case is common, build horizontal tools to sell across organizations. Spellbook raised $50 million at a $350 million valuation to do contract review across all different types of law firms.

Replace the workflow: LLMs have jagged edges. Therefore you should build traditional software to manage all the work AI can’t do and sell whatever AI works today. This is exemplified by Vertical SaaS players like Filevine [disclosure, a former employer of mine] and Clio. Both of these firms sell vertical SaaS that captures all of a law firm’s data and workflows, then adds on AI “modules” that they sell for an additional fee. So they’ll have products that compete directly with Spellbook or EvenUp. The Vertical SaaS pitch is that they already have all of the relevant data and can generate better AI results. Filevine recently raised $400 million at a $3 billion valuation.

Replace the employee: Junior employees don’t do work that is all that special, you can probably replace them with AI. In the legal field this is paralegals and fresh graduates of Harvard Law. AI can be a copilot for senior employees that replaces the work of juniors. Harvey is the chosen one who raised an €50 million Series E extension at a $5 billion valuation this week.

Replace the firm: Since AI is jagged, you can automate specific workflows and have humans do the rest by becoming a law firm yourself. Crosby raised $20m in Series A funding to start a new law firm that does contract review for tech companies. If you are keeping track, that is the same task that Spellbook is automating!

Every market will eventually have startups doing one of these five options. And, eventually, all of these companies will compete with each other. While I only worked in legal tech for 18 months, I can tell you that I learned that while technology is important, go-to-market is much more important. Lawyers are hard to sell to and hard to retain. (It is tough when your customers file lawsuits as a personal hobby!) It is worth asking for every AI market which companies have an unfair right to sell and win deals.

TASTEMAKER

Long-time readers know that I am a YouTube enjoyer. However, one thing I’ve been thinking about is how the medium changes how content is positioned.

For example, a channel I recently discovered called “Civ Div” has 1.37 million followers and is run by a soldier fighting for Ukraine. Most videos are him sharing GoPro footage from combat. Fighting footage is a long-existing genre—the thumbnails he uses are not.

Compare that thumbnail with Mr. Beast.

Compare how he does the title, and how face is the centerpoint of the thumbnail. Click maximization making its way into videos about drone warfare. Wild.

What’s wilder is seeing how being a Youtuber changes how the soldiers engage in combat itself. In this video from AZOV—a channel with 239,000 subscribers that is produced by an entire combat unit in Ukraine—soldiers are engaged in a firefight with a Russian soldier in a bunker. One of Azov’s soldiers yells to the person wearing the GoPro, “He’s [the Russian enemy] going to throw a grenade!” to which the recorder shouts “I’m faster” then chucks a grenade in. I’ve never been in combat before, but it is hard to imagine that shouting out quips that would perform well for an internet audience was a common part of warfare.

The comment section encourages it with stuff like, “”I’m faster” what a bad ass mf 😂😂” or “the way he said im faster was crazyyyyy.”

It is tempting to read my analysis about AI monetization as first world problems. These videos are why I consider The Leverage so crucial. Too often tech enthusiasts have sheltered behind the shield of return maximization so they don’t have to consider the far-ranging implications of their choices. Now, the preferences of Youtube’s algorithm directly alters life or death decisions on battlefields. You can’t simply evaluate these companies as static capitalist entities. They are culture, they are politics, they are sociology, and they are human nature, digitized. What I try to do here is connect the two. Capital leads to culture leads to consequences for everyone, even for those not using the products.

Have a great week,

Evan

Sponsorships

We are now accepting sponsors for the winter. If you are interested in reaching my audience of 35K+ founders, investors, and senior tech executives, send me an email at team@gettheleverage.com.

The essence of AI financing is project finance. It has been around forever. Back as far a Christopher Columbus. Oil used project finance to fund Saudi Arabia post World War II. Renewables started using it in the early 70s, with the financing for the geothermal power plant in China Lake.

It is important that people seem to forget the structure. Odd, or maybe normal, for Altman to think it's new. One fix in healthcare/food is to use project finance to alter our food infrastructure system to optimize for Human Health rather than crop commoditization.